What are Virtual CFOs and Virtual CFO Services?

From qualified accountants to experienced financial advisors, virtual CFOs (Chief Financial Officers) and virtual CFO services provide essential financial support for businesses big and small.

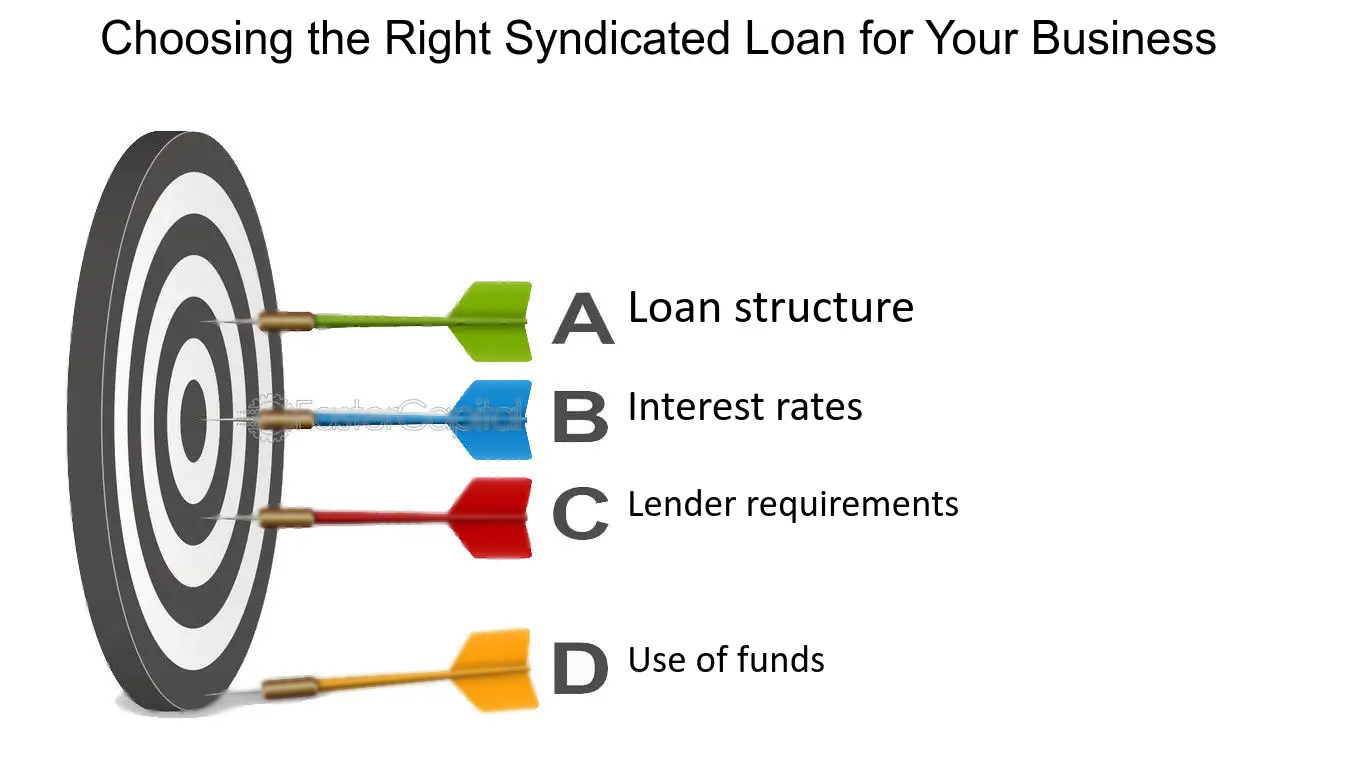

1. Loan structure: Syndicated loans can be structured in a variety of ways, including term loans, revolving credit facilities, and bridge loans. Each structure has its own benefits and drawbacks, so it's important to choose the one that best fits your business's financial situation and goals. For example, a term loan might be a good choice for a business looking to finance a long-term investment, while a revolving credit facility could be more appropriate for a business that needs ongoing access to capital.

What Is The Difference Between Virtual CFOs and In-House CFOs?

virtual CFOs are outsourced. They are a third party, functioning separately from your business at large. Immediately, this brings several benefits

Lower costs – Employing a full-time chief financial officer (as well as a team of accountants, bookkeepers, and managers) is extremely costly. The average salary for a CFO is over $120,000 per year.

Full team

– A virtual CFO can be one executive advisor, but virtual CFO services generally represent an entire team of financial professionals working simultaneously. Your virtual team will collaborate to provide you with the necessary functions and actionable information.

Low management – Your virtual team does not require the management a standard financial team could demand. Virtual CFOs are expected to produce real results for your team and, depending on your contract, organizational input may be minimal. Quality virtual CFOs function like other contract service providers—hitting deadlines, maintaining goals, and building the foundation for long-term success.

How Do Virtual CFOs Function?

Virtual CFOs are independent contractors. Typically, they work with several businesses at once, managing their various projects and business assets. On your end, this process will typically include:

Regular meetings – You may not need to manage your virtual CFO team, but it is important to check in regularly. Weekly, monthly, and quarterly meetings are par for the course with virtual CFOs. These are opportunities for refocusing, pivoting, or doubling down on various services and adjusting expectations and goals accordingly. Insights and Advice – A virtual CFO is more than an assistant responsible for financial services. They are also a trusted advisor, able to provide a unique perspective of your business and your future. From investment strategies to hiring practices, share ideas and spur further collaboration. Actionable data – Finance should be backed by hard numbers. Virtual CFOs are equipped with modernized software and digital tools to provide the most accurate metrics of your business. Not only can you expect actionable data, but you can also anticipate a thorough interpretation of data points, allowing you to create new corporate policies and adjust your business framework.

What Services Do Virtual CFOs Offer?

As virtual CFOs have grown in popularity, so have their service offerings. From the back of the office to the executive office, virtual CFOs offer a range of services that can be uniquely customized to fit your business. While every virtual CFO team may not offer the same services, the most popular options include:

Accounting – From bookkeeping to payroll, you can find virtual CFO services that can cover your entire accounting department. Never fall behind on bills, lose track of your ledger, or miss an important financial statement. With a virtual CFO, you can have a whole team of experienced accountants working to keep your finances organized and up to date. Investor preparation – Internal audits, pitch decks, and financial models are all essential for sourcing more capital for your business. If you are working toward fundraising and preparing to speak with investors, a virtual CFO can help ensure your presentation is clear, concise, and highly impressive. Financial forecasting – Growing businesses need insights into where they are and where they are going. With a virtual CFO providing a financial forecast for your venture, you can refine your business to ensure you are moving in the right direction. Pricing models and budgeting numbers can help provide you with a clear picture of what is next.

What To Know Before Hiring a Virtual CFO?

To retain virtual CFO services, you will need to seek individuals or service providers that align with your goals.

Vetting businesses

Consulting with financial teams

Exploring your financial needs

Building a customized CFO plan

Cost-breakdown – Virtual CFOs should be transparent. All costs and fees should be clear from the beginning, with any add-ons discussed ahead of time. You need a business that you can trust. After all, you are trusting them with your finances.

Expectations – What does your virtual CFO expect from you? They may require access to digital records, connections to resources, or even a full onboarding from your current financial team. Discover what you can do to make a smooth transition and encourage an atmosphere of collaboration.

Industry experience – It could be worthwhile to investigate a virtual CFO with experience in your specific field. Every industry has its quirks and specialties, and hiring a virtual CFO with some familiarity will provide stronger insights and more helpful strategic advice.